Get an LLC: How To Setup Payroll For LLC. Business names, create an LLC, Business registration

& Company registration numbers. Easy Setup! Fast turn around time!

Exactly how to obtain an LLC – How To Setup Payroll For LLC

To create an LLC, you will need to adhere to these steps:

Choose a name for your LLC that is not already being used by an additional business and also is compliant with your state’s calling regulations. How to setup payroll for LLC.

File articles of organization with your state’s LLC filing workplace. This paper officially creates your LLC as well as includes information such as the name as well as address of the LLC, the names and also addresses of the participants, and the function of the LLC.

Obtain any necessary licenses and also allows for your business.

create an operating arrangement, which outlines the administration as well as economic structure of the LLC.

Pay any kind of needed fees to the state for registering your LLC.

Note: How to setup payroll for LLC. The procedure for forming an LLC will differ relying on the state where you intend to create it. It is suggested to speak with a lawyer or an accountant who can lead you on the certain rules and also guidelines of your state.

Exactly how to obtain a business license

Establish the kind of business license you need: Depending on the type of business you intend to operate, you may require a specific kind of license. If you intend to offer alcohol, you will need a liquor license.

Study regional as well as state requirements: Each state and also district has its very own collection of regulations and also guidelines for acquiring a business license. How to setup payroll for LLC. You’ll need to investigate the specific demands for your area to ensure you have all the required documents and also paperwork.

Gather called for records: You will certainly need to give specific documents, such as evidence of your business name and also address, tax identification number, as well as evidence of insurance. Make certain you have every one of these files before obtaining your license.

Apply for your license: Once you have all the necessary documents, you can apply for your business license by submitting the suitable paperwork to your local or state federal government company. This can be done online, by mail, or face to face.

Pay the needed cost: How to setup payroll for LLC. You will require to pay a charge to get your business license. The charge amount varies depending on your place and also the type of business you are operating.

Wait for authorization: After you have actually sent your application as well as paid the required cost, you will require to wait for your license to be authorized. The approval procedure can take numerous weeks, so hold your horses.

Keep your license updated: How to setup payroll for LLC. Once you have your business license, you will certainly need to maintain it updated by restoring it annually or as required by your neighborhood or state government.

Exactly how ahead up with a business name – How To Setup Payroll For LLC

Start by brainstorming key words that associate with your business. How to setup payroll for LLC. These can include the product and services you supply, the target audience, or any distinct attributes of your business.

Think of the character or tone you want your business name to convey. Do you want a name that is significant and also expert, or something a lot more enjoyable and catchy?

Consider making use of a combination of words that relate to your business. This can consist of industry-specific terms, or words that show your firm’s values or objective.

Play around with various word mixes and also see what appears excellent. You can additionally use a business name generator tool to help you think of suggestions.

Examine the schedule of your selected name by searching online as well as inspecting if the domain name is readily available.

Obtain responses from buddies, family members, as well as coworkers to see if they such as the name and if it conveys the best message.

When you have actually decided on a name, make certain to register it with the suitable government agency and also protect the needed hallmarks as well as copyrights to secure your business name.

Just how to create an LLC

Pick a one-of-a-kind name for your LLC: Your LLC name need to be distinguishable from other business names on data with your state’s LLC filing workplace.

Select a registered Agent: How to setup payroll for LLC. A signed up Agent is a person or business entity that will accept lawful papers in behalf of your LLC.

Submit articles of organization: This is the paper that officially produces your LLC as well as should be submitted with your state’s LLC filing workplace.

Acquire any required licenses and also licenses: Depending upon your business kind as well as location, you might need to obtain added licenses and also authorizations.

create an operating arrangement: An operating contract is a legal paper that describes the possession and management framework of your LLC.

Get an EIN: An EIN, or Employer Identification Number, is a unique number assigned to your business by the internal revenue service for tax obligation purposes.

Register for state tax obligations: Depending upon your state, you may need to register for state tax obligations, such as sales tax or pay-roll tax obligations.

Adhere to recurring compliance needs: LLCs are subject to recurring compliance demands such as annual reports as well as franchise tax obligations.

Open up a business savings account: Open up a business checking account to keep your personal and business finances separate.

How to setup payroll for LLC. File annual reports and taxes: LLCs are required to submit annual reports and also tax obligations, get in touch with your state for specific needs.

New Jersey business registration – How To Setup Payroll For LLC

In order to register a business in New Jersey, the adhering to actions have to be completed:

Select a business name: How to setup payroll for LLC. The business name have to be special and not currently in use by one more business. The name can be checked for availability with the New Jersey Division of Revenue as well as Venture Services.

Register for tax obligations: How to setup payroll for LLC. All organizations in New Jersey are required to register for state tax obligations, including sales tax, company withholding tax, as well as unemployment tax obligation. This can be done through the New Jersey Division of Revenue as well as Enterprise Solutions.

Obtain any kind of necessary licenses or authorizations: Relying on the sort of business, particular licenses or licenses might be called for. How to setup payroll for LLC. This includes licenses for certain professions, such as healthcare providers or building and construction contractors, in addition to licenses for certain activities, such as food service or alcohol sales.

Register for a business entity: Companies in New Jersey can pick from a number of various sorts of lawful structures, such as sole proprietorship, partnership, limited liability company (LLC), or firm. How to setup payroll for LLC. The appropriate framework ought to be chosen based upon the particular demands of business.

Submit articles of incorporation (if applicable): If the business is a firm, articles of unification should be submitted with the New Jersey Division of Revenue and Venture Providers. This process consists of sending a certificate of unification as well as paying a charge.

Register for employee withholding tax obligations: How to setup payroll for LLC. Businesses with workers should register with the New Jersey Division of Revenue as well as Business Services to report as well as remit worker withholding tax obligations.

Obtain any required insurance coverage: How to setup payroll for LLC. Relying on the type of business, specific types of insurance coverage may be called for, such as employees’ payment insurance.

Once all of these steps have been completed, the business will be formally registered and able to operate in New Jersey. It is important to keep in mind that continuous conformity with state regulations and laws is likewise needed to keep enrollment.

What is a business in a box? How To Setup Payroll For LLC

A business in a box is a pre-packaged set of sources, tools, as well as materials that are made to help business owners rapidly and quickly start and also run their own business. How to setup payroll for LLC. These sets commonly include points like business plans, layouts, advertising materials, training overviews, and also software program or other devices that specify to the kind of business being begun. Some examples of business in a box include franchises, on-line organizations, as well as home-based services. These packages can be customized to fit different markets and also business versions, and can be a excellent means for people to start their very own business without having to invest a lot of money and time on research and development.

How To Register business name

Select a one-of-a-kind business name: Before registering your business name, make certain it is distinct as well as not currently in use by another company. You can make use of a business name search tool to examine if the name is readily available.

Determine the type of business entity: Select the kind of business entity you intend to register as, such as a sole proprietorship, partnership, LLC, or corporation.

Register with the state: Most states need services to register with the state federal government. How to setup payroll for LLC. This can typically be done online or personally at the ideal government firm.

Acquire any type of necessary licenses and permits: Relying on the type of business you are operating, you may require to get specific licenses and also permits. These can differ by state as well as industry, so it is essential to study what is needed for your business.

Register for tax obligations: Register for any kind of required state and also federal taxes, such as sales tax and revenue tax obligation.

Declare a DBA Doing Business As if necessary: If you’re operating under a name that’s different from your legal name, you’ll need to declare a DBA.

Maintain documents: Keep all enrollment documents, licenses as well as allows in a refuge for future reference.

What is a Business registration number? How To Setup Payroll For LLC

A company registration number, likewise called a company enrollment number or business registration number, is a one-of-a-kind identification number appointed to a firm by a federal government agency. How to setup payroll for LLC. This number is made use of to determine the business for legal and also administrative purposes, such as declaring tax obligations, opening checking account, and performing business transactions. The layout and place of the enrollment number may differ depending upon the country or state in which the company is registered.

Northwest Registered Agent

Northwest Registered Agent is a business that offers registered Agent solutions to businesses in the USA. They function as the official factor of get in touch with for a business, getting and forwarding legal papers, such as service of process and also annual reports. How to setup payroll for LLC. They likewise help organizations stay certified with state regulations by supplying pointers for essential filings and also due dates. Northwest Registered Agent has stayed in business because 1998 and is headquartered in Washington state. They currently serve over 250,000 services throughout the nation.

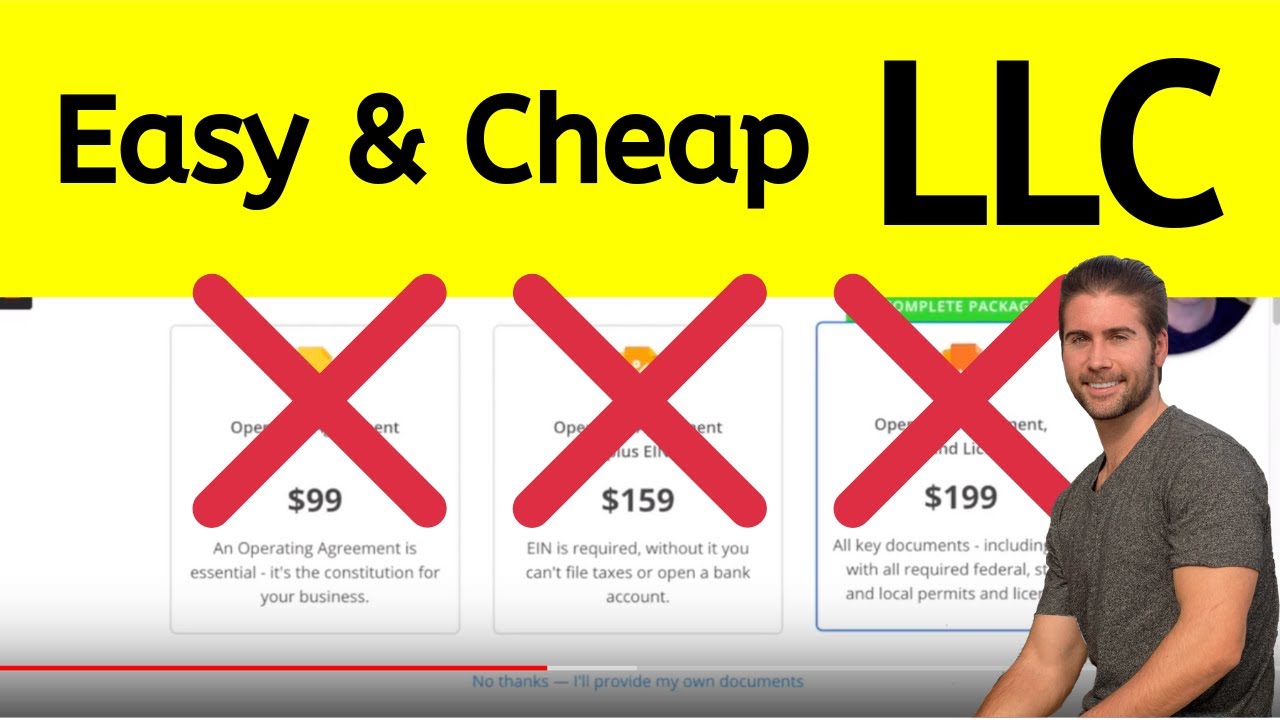

Incfile

Incfile is a business that provides business formation solutions, consisting of LLC development, corporation development, and also not-for-profit development. How to setup payroll for LLC. They additionally supply services such as registered Agent solution, compliance solutions, as well as business paper filing.

What is Inc Authority? How To Setup Payroll For LLC

Inc Authority is a business that offers lawful, tax obligation, and also compliance solutions for businesses. How to setup payroll for LLC. They assist entrepreneurs and also small business owners include their businesses, manage their lawful and also tax obligation commitments, and also make certain that they are in conformity with all appropriate laws and regulations. Their services include company development, registered Agent solutions, trademark enrollment, business license and permit aid, and also more.

Zenbusiness

Zenbusiness is a firm that uses business formation and also assistance solutions to entrepreneurs and also small business proprietors. They supply support with setting up a new business, including selecting a business structure, acquiring essential licenses and also authorizations, and registering with state and also government firms. How to setup payroll for LLC. They likewise supply recurring assistance solutions such as accounting, tax preparation, and also registered Agent services. Their goal is to streamline the procedure of starting and running a business, so entrepreneurs can concentrate on expanding their business as well as attaining their objectives.

Swyft Filings

Swyft Filings is a US-based on-line lawful service that offers an cost effective as well as simple method for organizations to include or create an LLC (Limited Liability Company). How to setup payroll for LLC. They provide a range of services including business registration, trademark filing, and also annual report solutions. Swyft Filings is known for their user-friendly website as well as their dedication to offering a fast and efficient service. They also use a 100% contentment assurance and a online registered Agent service.